Loyalty-based segmentation helps small businesses focus on their most valuable customers by grouping them based on purchasing behavior, engagement, and spending patterns. This strategy uses metrics like Recency, Frequency, and Monetary (RFM) scores to prioritize efforts and resources effectively. Key customer segments include:

- VIP Customers: Top spenders who drive most of your revenue.

- At-Risk Customers: Previously active shoppers who haven’t engaged recently.

- New Customers: First-time buyers within their initial 30-day window.

How Does Customer Segmentation Improve Customer Loyalty?

Key Metrics for Customer Segmentation

Metrics transform raw data into actionable insights, helping small businesses focus their marketing efforts where they matter most. By identifying who’s engaged, who’s slipping away, and where to allocate resources, businesses can maximize their impact. One powerful tool for this is RFM scoring, which provides a structured way to evaluate customer value.

Recency, Frequency, and Monetary (RFM) Scoring

RFM scoring evaluates customers based on three key factors: Recency (when they last purchased), Frequency (how often they buy), and Monetary Value (how much they spend) [6]. Businesses typically use a 1–5 scale for scoring, though smaller customer bases (under 30,000) might adjust to a 1–3 scale, and medium-sized bases (30,000–200,000) might use 1–4. A “555” score represents top-tier customers, often labeled as "Champions" or "Soulmates" [8].

Here’s how it works in practice: In 2024, Ronan Walsh, Managing Director of Digital Trawler, used RFM analysis for a B2B SaaS company with 2,000 active customers. By tailoring offers based on recent engagement data, the company boosted customer retention by 15% and increased average order value by 10% within six months [6]. Similarly, Ani Ghazaryan, Head of Content & Marketing at Neptune.AI, focused on high-recency, high-frequency users by delivering educational content. This effort led to a 20% rise in engagement, a 15% drop in churn, and a 10% increase in customer lifetime value [6].

"Why am I sending the same offers to a $20 customer that I would give my $100 customer?" – Jimmy Kim, CEO, Royal Prospect [6]

Engagement and Referral Data

Beyond purchases, behavioral data gives businesses deeper insights into customer loyalty. Metrics like email open rates, click-through rates, social media interactions, and website behavior – such as views of product detail pages – help paint a more detailed picture of customer interest [7]. Referral data is particularly valuable, as customers who actively recommend your brand are often among your most loyal, falling into categories like "Champions" or "Potential Loyalists" [6].

For B2B and SaaS businesses, engagement metrics can include feature usage, login activity, or subscription renewals [9]. Personalization plays a big role here – research shows customers spend 38% more when their experience is tailored to them [6].

Inactivity and Churn Indicators

Spotting early warning signs of churn allows businesses to intervene before losing customers. This complements RFM analysis by identifying behavioral shifts that suggest disengagement. For example, a decline in recency or frequency scores, high product return rates, or an uptick in customer support tickets can all signal potential churn [6][7][8]. Setting up CRM alerts for drops in high-value customers’ recency scores can help businesses act quickly to retain them [9].

Retention is critical – acquiring a new customer costs up to five times more than keeping an existing one [7]. Yet, 70% to 85% of new customers are lost after their first purchase [8]. For e-commerce businesses, cart abandonment alone leads to an estimated $18 billion in lost revenue annually [10]. By monitoring these indicators, businesses can launch re-engagement campaigns before it’s too late.

Main Customer Segments for Small Businesses

Once you’ve gathered your metrics, the next step is to group your customers into meaningful categories. For small businesses, focusing on three key customer segments often yields the best results for boosting revenue and retention. These segments are defined by behavioral patterns that shape how customers interact with your brand. Each group requires tailored strategies to enhance engagement and maximize returns.

VIP and High-Value Customers

Your VIPs are the top 20% of customers who generate the lion’s share of your revenue [2]. These aren’t necessarily your most frequent buyers – they’re the ones who excel across all three RFM (Recency, Frequency, Monetary) metrics: recent purchases, frequent transactions, and high spending.

For this group, exclusivity and premium experiences matter more than basic discounts [1][11]. Think early access to products, invites to exclusive events, or VIP-only perks. Studies show that businesses that segment their customers are 60% more likely to understand their needs and 130% more likely to anticipate their intentions [11]. By customizing offers for VIPs, you could see a 10–15% boost in revenue compared to using a one-size-fits-all strategy [11]. This aligns perfectly with the lifetime value strategies mentioned earlier.

"I strongly advocate programs whose cornerstone and standard mechanism is to reward the customer for each purchase behavior. This incentivizes the consumer to identify themselves as a loyalty program member with each transaction… the brand gains the user’s entire purchase history, which allows for more accurate segmentation." – Monika Motus, Loyalty Expert [2]

At-Risk or Inactive Customers

At-risk customers are those who used to shop regularly but haven’t made a purchase in over 90 days [1][12]. These individuals once had high frequency and monetary scores but now show low recency, signaling potential lost revenue. Acting quickly can help re-engage them and prevent permanent churn.

Win-back campaigns tailored to this group can be highly effective. Personalization is key – 70% of customers say they’re more likely to stay loyal to a brand if they receive offers tailored to their preferences [3]. Acknowledging their past relationship with your business in your messaging can make these campaigns far more impactful than generic promotions.

New Customers

New customers are those who’ve made their first purchase and are within their first 30 days of doing business with you [1][3]. This is a critical period where you introduce them to your brand’s value and set the stage for long-term loyalty. Roughly 15% of your customer base typically falls into this category [2], and how you engage them now can determine whether they become repeat buyers or fade away.

The goal here is to create immediate engagement. Encourage actions like following your social media, completing a profile, or leaving a review [1]. A personalized onboarding experience can significantly increase the chances of repeat purchases. Offering welcome bonuses or sharing educational content about your products or services helps new customers see why they should stick around for the long haul.

How to Implement Loyalty Segmentation

Setting Clear Goals

Start by defining specific, measurable objectives for your segmentation efforts. For instance, you might aim to increase repeat purchases, reduce customer churn, or boost the average order value. These goals should be actionable, like improving repeat purchase rates among recent buyers or reengaging inactive customers. Clear targets not only guide the creation of customer segments but also help you measure their success effectively [2].

"Loyalty segmentation aims to enhance customer loyalty and maximize customer lifetime value. In addition to the primary objective, it also has secondary goals, including optimizing resource allocation, discovering valuable insights through data analysis, and fostering involvement and gratification." – Paweł Dziadkowiec, Loyalty Strategy Consultant [2]

Once your objectives are in place, the next step is to gather the data needed to build meaningful customer segments.

Collecting and Analyzing Data

To create effective segments, you’ll need three key types of customer data:

- Transactional data: Includes purchase history, average order value, and purchase frequency.

- Behavioral data: Tracks website visits, email engagement, and app usage.

- Zero-party data: Gathered directly from customers through surveys, quizzes, or preference centers, capturing insights like product interests or preferred communication methods [2].

Start by analyzing existing point-of-sale or e-commerce data, focusing on 12–18 months of transactional data to assess customer value using metrics like Recency, Frequency, and Monetary value (RFM). Ensure your data is clean by removing duplicates and outdated entries. To enrich your dataset, consider offering small incentives – like bonus loyalty points – to encourage customers to update their profiles or share preferences [3].

With clean, comprehensive data in hand, you’re ready to define actionable customer segments.

Creating and Naming Segments

Using your goals and data as a foundation, begin by creating three to five primary customer segments. Avoid overcomplicating things with too many micro-groups initially. Common starting segments might include:

- VIPs: The top 10–20% of customers based on spending or purchase frequency.

- At-risk customers: Those who haven’t made a purchase in over 90 days.

- New members: Customers who joined your loyalty program within the last 30 days [1].

Give each segment a name that reflects customer behavior, such as "Steady Steppers" for consistent buyers or "Seasonal Sprinters" for those who shop during sales. Each segment should have a clear purpose and corresponding marketing action [1].

It’s also important to set up dynamic segments. This ensures customers move automatically between groups as their behaviors evolve. For example, a VIP customer who goes 90 days without making a purchase should seamlessly transition into the at-risk category without requiring manual updates [1].

sbb-itb-aebd855

Targeting Strategies and Personalization

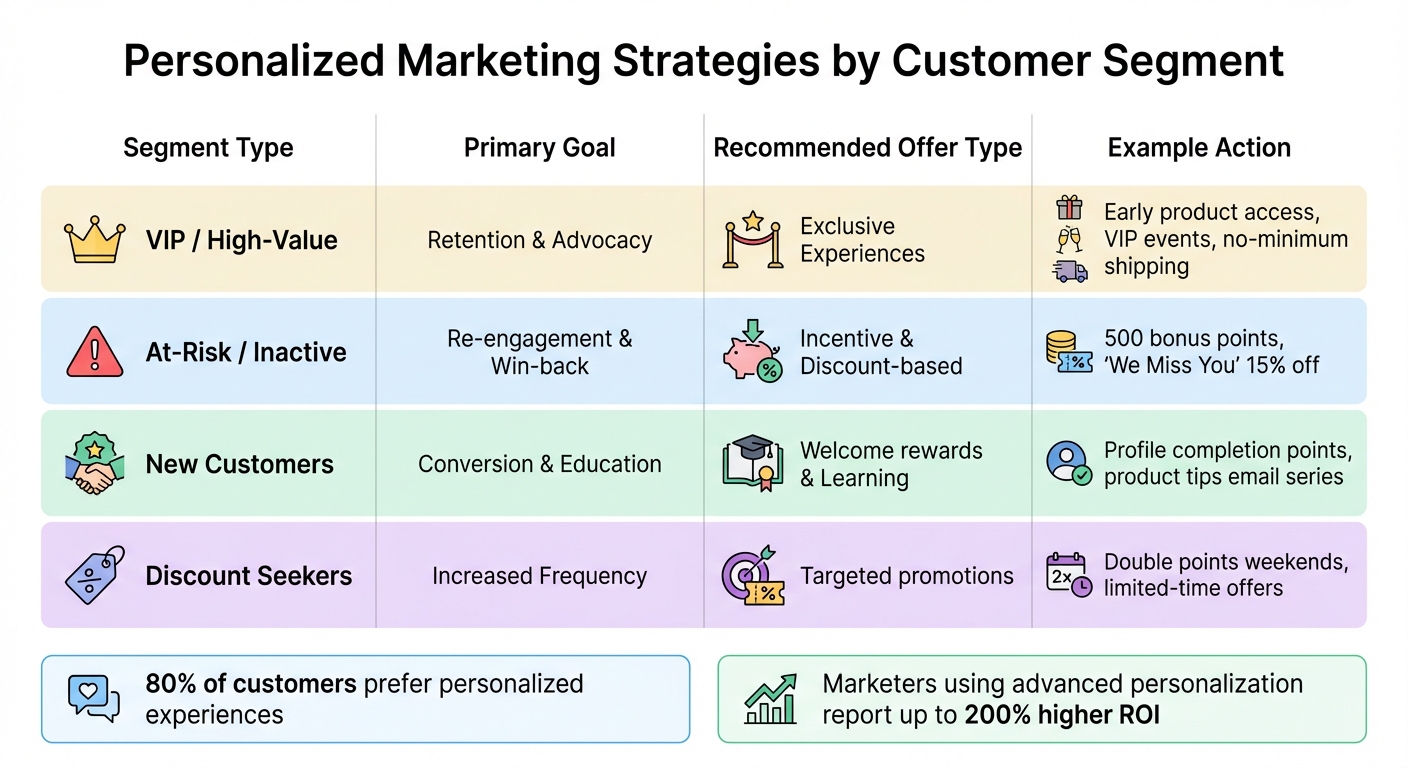

Personalized Marketing Strategies by Customer Segment

Once you’ve segmented your customers, the next step is crafting marketing strategies that resonate with each group’s unique preferences. Why is this so important? Research highlights that 80% of customers are more likely to purchase from brands offering personalized experiences [15]. On the flip side, 76% of consumers feel frustrated when marketing communications lack personalization [16]. Clearly, tailoring your approach can make or break customer relationships.

For VIP customers, additional discounts aren’t necessary – they’re already invested in your brand. Instead, focus on making them feel valued through exclusive perks. Offer them early access to new products, invitations to members-only events, or benefits like free shipping without a minimum purchase [3][17]. These thoughtful gestures can deepen loyalty and encourage long-term advocacy.

When it comes to at-risk or inactive customers – those who haven’t made a purchase in over 90 days – re-engagement campaigns can work wonders. A targeted incentive like, “Earn 500 bonus points on your next purchase,” is far more effective than generic messaging [1][17]. Adding urgency helps too: include a clear expiration date, follow up within two weeks, and send a final reminder two days before the offer expires [2]. Interestingly, dollar-off discounts (like "$10 off") tend to outperform percentage-based offers in these scenarios, doubling their effectiveness [20].

New customers, however, require a different approach. They’re not ready for heavy promotions yet – they need education. A well-designed automated welcome sequence can do the trick. Reward actions like completing their profile, introduce them to your loyalty program, and recommend products tailored to their interests [3][5][17]. To build early engagement, consider offering points for actions like following your brand on social media.

For discount seekers, the goal is to encourage frequent purchases. Targeted promotions, such as double points weekends or limited-time offers, can be highly effective at driving repeat business [2][3].

Here’s a quick summary of personalized strategies for different customer groups:

| Segment Type | Primary Goal | Recommended Offer Type | Example Action |

|---|---|---|---|

| VIP / High-Value | Retention & Advocacy | Exclusive Experiences | Early product access, VIP events, no-minimum shipping [3][17] |

| At-Risk / Inactive | Re-engagement & Win-back | Incentive & Discount-based | 500 bonus points, "We Miss You" 15% off [1][17][18] |

| New Customers | Conversion & Education | Welcome rewards & Learning | Profile completion points, product tips email series [3][17][18] |

| Discount Seekers | Increased Frequency | Targeted promotions | Double points weekends, limited-time offers [2][3] |

Marketers who embrace advanced personalization report up to 200% higher ROI [19]. The takeaway? Success lies in addressing each segment’s specific needs, moving away from a one-size-fits-all approach. Personalization isn’t just a buzzword – it’s a proven strategy to drive results.

Common Challenges and Best Practices

Once you’ve mapped out your segmentation strategies, the next step is tackling the hurdles that can arise when running a loyalty program. For small businesses, maintaining effective programs often comes with its fair share of challenges.

Managing Limited Resources

Small businesses often wrestle with "tool fatigue", trying to manage rewards, referrals, and reviews across several disconnected platforms [5]. The key here? Start small and keep it simple. Focus on a few essential customer segments and gradually expand as you refine your processes [1][2].

Using a unified platform for loyalty, reviews, and referrals can be a game-changer. Not only does it cut costs, but it also eliminates siloed data [5]. Keep your program straightforward – make the rules easy to understand with clear earning structures. This simplicity benefits both your team and your customers [5]. Automation can also ease the load: set up features like welcome emails, point-balance reminders, and targeted campaigns to run automatically. This frees up your team to focus on strategy rather than day-to-day tasks [16][13].

Ensuring Data Privacy and Ethics

Trust is the cornerstone of any customer relationship, and transparency plays a big role in building it. Be upfront about how you collect, store, and use customer data [3]. Always get explicit consent before using customer information for marketing or segmentation, and honor opt-out requests immediately [5]. Compliance with regulations like GDPR and CCPA is non-negotiable – it’s essential for maintaining customer confidence [2][5].

When gathering data, less is more. Focus on collecting zero-party data – information customers willingly share through surveys or quizzes. This type of data is not only more reliable but also aligns with ethical practices [2][3]. You can encourage participation by offering loyalty points for completing preference surveys. Make sure your datasets stay fresh by regularly updating them to reflect current customer behavior. Stale data can lead to inaccurate segmentation and missed opportunities [2][4].

With secure data protocols in place, you’ll be better equipped to refine your segmentation strategies.

Testing, Learning, and Adapting

Customer behavior isn’t static, and your segmentation tactics shouldn’t be either. As the market shifts, your strategies need to evolve. Static segments can quickly lose relevance. For example, offering a welcome discount to a long-time customer doesn’t make sense and could even damage the relationship [1]. This is where dynamic segmentation comes in – customers can move between groups automatically based on their real-time behavior [1][4]. Set a schedule to review your segment definitions every few months to ensure they still align with your business goals [1][2].

Before rolling out new approaches on a large scale, test them on smaller groups. For instance, you could try a "We Miss You" campaign offering 500 bonus points to one group of at-risk customers and compare it to a 15% discount offer for another group [1]. Experiment with different messages and timing to see what resonates. Keep in mind that while your VIP customers (about 20% of your base) may drive most of your revenue, even a slight increase in purchase frequency from less frequent buyers can have a noticeable impact on your bottom line [2]. The key is to keep testing, measuring, and fine-tuning based on the results.

Conclusion and Key Takeaways

Recap of Benefits

Loyalty-based segmentation transforms how businesses connect with their customers. Instead of a one-size-fits-all approach, it allows for tailored communication that genuinely resonates. In fact, research highlights that 81% of consumers prefer brands that personalize their experiences [14].

By tapping into first-party data from loyalty programs, you can reduce your reliance on costly paid advertising [5]. This data also helps identify customers who may be at risk of leaving, enabling you to allocate your marketing budget where it delivers the greatest impact [1]. Interestingly, while VIP customers make up just 20% of your customer base, they generate the lion’s share of revenue [2]. For example, at Shoppers Stop, loyalty members account for a staggering 70% of the company’s total sales [13].

But the benefits don’t stop at revenue. Segmentation fosters a sense of community, encouraging loyal customers to refer friends and leave glowing reviews. This creates a cost-effective way to bring in new customers [5].

With all these advantages, it’s clear that loyalty-based segmentation is a strategy worth implementing.

Next Steps for Implementation

Start by focusing on three to five impactful segments. VIPs, at-risk customers, and new members are excellent places to begin [1]. Use the RFM model – Recency, Frequency, Monetary – as the foundation for your segmentation, and ensure your segments update dynamically to reflect changes in customer behavior [1][3].

Test your strategies with a small group and track the results. Revisit and refine your segment definitions every few months to ensure they align with your evolving business goals [1][2]. Even modest improvements, like increasing the purchase frequency of mid-tier customers, can significantly boost your bottom line [2]. Keep it simple, measure what works, and expand as you gain insights into what resonates with your audience.

FAQs

What is RFM scoring, and how can small businesses use it effectively?

RFM scoring – short for Recency, Frequency, and Monetary value – is a straightforward way to gauge customer loyalty. It looks at three key factors: how recently a customer made a purchase, how often they buy, and how much they spend. This method helps small businesses pinpoint their best customers to reward, identify those at risk of leaving, and figure out how to engage lower-spending customers with tailored offers.

To get started with RFM scoring, you’ll need to gather some basic transaction data: customer IDs, purchase dates, and amounts spent. Choose a specific time frame to analyze (e.g., from January 1, 2025, to December 31, 2025) to focus on recent trends. Then, rank each customer on a scale (like 1 to 5) for each category – Recency, Frequency, and Monetary value. Combine these rankings into a three-digit code. For example, a "555" would represent a top-tier customer across all three dimensions. Once you’ve segmented your customers, you can create targeted marketing strategies, such as offering exclusive deals to your most loyal customers or launching re-engagement campaigns for those who might be slipping away.

If setting up RFM scoring feels overwhelming or you’re looking for help with marketing strategies, ChrisRubinCreativ (CRC) can lend a hand. They specialize in helping businesses grow with customized approaches and impactful storytelling.

How can small businesses re-engage customers who might stop shopping with them?

Loyalty-based segmentation helps pinpoint customers who might be drifting away from your brand. Once identified, you can reach out to them with customized win-back strategies that feel personal and relevant. These could include special offers, exclusive perks, or messages tailored to their past shopping behavior.

For instance, you might send them a discount on an item they’ve bought before or craft a thoughtful message that highlights why your brand stands out. The goal is to create a connection that resonates, showing them you genuinely value their preferences and continued loyalty.

Why is personalization crucial for loyalty-based segmentation?

Personalization matters because it makes customers feel appreciated and understood, creating stronger connections and encouraging loyalty over time. When businesses customize rewards and interactions to match individual preferences, they often experience better engagement, higher revenue, and an increase in customer lifetime value.

Research highlights this impact clearly: companies experiencing rapid growth generate about 40% more revenue through personalized interactions. Additionally, nearly 70% of customers are more likely to stick around when rewards align with what they care about. For small businesses, prioritizing personalization can lead to meaningful relationships and steady growth.